![]() DJH: This is the final installment of my analysis of Barack Obama’s 2010 Federal Budget. In the first three posts, I answered the rhetorical questions: “How Big is It,” “Who Gets Hurt,” and “Hyperinflation; What is it and Could it Happen Here?”

DJH: This is the final installment of my analysis of Barack Obama’s 2010 Federal Budget. In the first three posts, I answered the rhetorical questions: “How Big is It,” “Who Gets Hurt,” and “Hyperinflation; What is it and Could it Happen Here?”

Those of you who know me, know that I never bring up a problem without having a solution. This is not a simple problem and thus neither is my solution.

Dave

10 Strategies to End Chronic Deficit Spending in the United States

1. Elect 67 Fiscally Conservative Senators ASAP: I actually have 9, not 10 strategies for ending deficit spending in America, but the truth is, as long as we have social ideologues and spineless RINO’s sitting in congress, it is unlikely any of my strategies will come to pass. I say 67, because that’s the number required to override a presidential veto. If we ever got a fiscally conservative president, we would only need 60 seats in the senate. Of course, if we had 67 fiscally conservative senators, we won’t need my other 9 strategies – because they’d do the right thing in the first place. But please read on, just to humor me!

2. Freeze Federal Spending ASAP [as a first step]: I’m talking across the board, including defense, Social Security, and, Medicare. This is what every fiscally responsible organization does when their sales, revenue, or donations decline. It’s essential for survival. Sure, our troops need more money, but we all know that there are dozens of new weapon programs that we either don’t need, or that are full of pork spending. I say, force the pentagon to make these choices. I’d rather have our generals do it than bureaucrats in congress.

How can I suggest that we freeze education spending? Hey, pay attention, I covered that last week in my piece “Our Education System is Going No Where Fast” by pointing out that we already outspend ever other nation on earth in education and I cited proven ways to cut educational spending and instantly improve our “bang for the buck.

Finally, as you’ll see below, I also think we must reel in entitlement growth that is being annually fueled by automatic Cost of Living Adjustments (COLA). Keep in mind, that this is a first step. It would demonstrate that we are serious about fiscal discipline and make the other 8 strategies more palatable.

3. Stabilize Economically Sensitive Tax Plans: Virtually everyone who understands economics agrees that Obama is killing the economy by floating some new plan to increase taxes every time he opens his mouth.

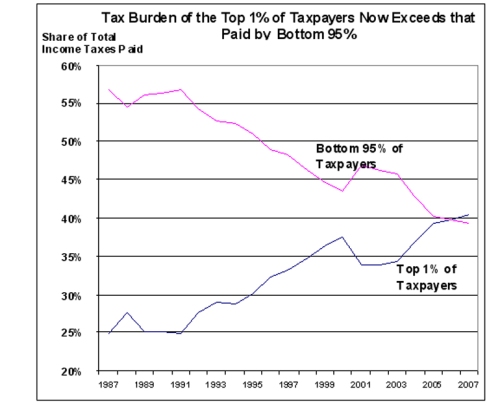

Get this: last year, for the first time in history, the top 1% of all wage earners in the US paid more in taxes (40%) than the bottom 95% (39%), and oh yeah, the bottom 40% of all wage earners PAY NO INCOME TAXES WHATSOEVER!

Despite all the liberal hand wringing over “tax cuts for the rich,” the cold hard facts don’t lie. According to Obama’s own economic advisor Peter Orszag, the Bush Tax Cuts actually resulted in greater tax collections and reduced the deficit. Of course, as we are all learning daily, these tax rates for the wealthy are also the tax rates for small businesses – who once created 80%+ of all new jobs in America — before Obama took charge.

Another constant whine from the left is that greedy American corporations keep moving jobs offshore. The truth is they do, but not because of corporate greed, it’s due to greedy tax collectors. The main reason US corporations move jobs offshore is corporate taxes. Look at the chart below, the US ranks 3rd behind Japan and Germany when it comes to having the highest corporate tax rates on earth!

And while I think the taxes on the wealthy and the taxes on corporations are too high, that’s not what I’m talking about here. I’m talking about Obama’s constant babble about future tax plans. It’s making everyone who runs a business in the private sector very nervous. Every successful business I’ve ever worked for plans years in advance, particularly when it comes to launching new products or building new facilities; the things that drive up hiring. But how can they plan when Obama, Reid, and Pelosi “float” plans for new taxes on them on a weekly basis? This is particularly true when it comes to capital gains and corporate taxes.

So, strategy number 3 for saving us from chronic deficit spending is to stabilize key economic taxes like the corporate tax rate, the capital gains tax, and the top individual tax rates that impact most small business. I think they should be frozen for 4 years at a time and it should require a 2/3’s majority in congress to change them within that window. The 4 year window should align with the first year of a president, so he/she can run on their “tax and spend plans.” This would enable us to vote for what we want and it would enable businesses to plan. I truly believe this would spark a new wave of economic growth. It would also force government bureaucrats to focus more on spending and less on taxes when they try to balance the budget.

4. Cut Government Worker Pay by 5-10%: Liberals tell us that the government stimulus plan was a success because it “saved” some large number of government jobs. You know what? I think that’s true. But we could have saved all of those jobs without destroying the treasury by doing what most private sector employers do when times are tough and they don’t want to have a lay-off. We could have cut government wages by, say, 5-10%. Today, government workers earn almost double what private sector workers make, and there wages have risen at 3 times the rate of private sector wages. It is really the only fair way to save jobs and cut the deficit. My 4th strategy is to save government jobs by cutting pay, not cutting headcount (necessarily). By the way, I’m not talking about furloughs like we have in California where they get every other Friday off in exchange for a 10% pay cut. I want them to work the same hours they always worked, but do it for less money – just like regular workers in the private sector.

5. Replace COLA entitlements with the Private Sector Wage Inflation Index: Government compensation schemes tie most annual pay or benefit increases to the Cost of Living (COLA) index. This index “leads” inflation to make sure you have an extra buck in your pocket when the price of a gallon of milk goes up. This is great for government workers, but is it fair? When the economy nose dives, workers in the private sector don’t get an automatic raise, in fact, they often take a pay cut. My 5th strategy is to tie all government compensation payments to the Private Sector Wage Index, which tends to lag COLA and truly represents the income level of working Americans. Government workers should never get pay raises that are bigger than those granted in the private sector. By the way, this would not just apply to government wages, it would also apply to government pensions and Social Security payment increases.

6. Set Government Worker Retirement at 65: One of the things that drives most sane people crazy is to hear a story about some city bus driver who “retired” before the age of 50, started collecting a fat pension (tied to COLA), and then went to another job (maybe another government job), and started down the track to a double dip retirement. In a courageous speech last week, the recently elected Governor of New Jersey Chris Christie cited a couple of examples of government workers who retired early with pensions worth as much as 20 times the amount of money they had contributed. While a big piece of this problem is due to the lucrative pensions themselves, the fact is the cost to the tax payers would be reduced dramatically, if government workers just had to wait until their 65th birthday to start collecting benefits — like all of the private sector workers who must pay into Social Security.

7. Phase out Civil Servant Pensions; Move Everyone to 401K’s: Why do government workers have public pensions in the first place? Why don’t they have 401K’s like the rest of us? They make more money than private sector workers; they can afford to save some of it — just like everyone else.

8. Contain Healthcare Costs: As we’ve all learned over the past year, the skyrocketing cost of healthcare combined with runaway entitlements is another piece of what’s driving chronic deficit spending. And, as we’ve also learned, Obamacare does nothing to contain healthcare costs; it simple expands entitlements and passes the tab on to the private sector in the form of new taxes on small business owners.

Here are a few of the things I’d like to see in healthcare reform:

Tort Reform – According to a 2006 study from Price Waterhouse Coopers, Medical Malpractice lawsuits and the defensive medicine they drive inflate the cost of healthcare in America by 10%. That is a huge number; the US Department of Health and Human services reported that we spent $2.3 trillion on health care in 2008. 10% of that is $230 billion, which is more than enough to cover every one of the 30 million uninsured Americans with a pretty good insurance policy!

Cross State Competition – People don’t realize that the states drive up the cost of health care by mandating what gets covered. Massachusetts may tell insurance companies that they must cover sex change operations for domestic partners, while Texas does no such thing. Insurance in places like Texas is always cheaper and I’d rather buy my insurance there.

Catastrophic/HSA’s For All – I have an insurance policy that makes me pay the first $3,500/year in healthcare costs. It’s not only cost effective, but I can tell you that it makes me think twice before I go to see a doctor. This is similar to the plan that Whole Foods has for all of their employees that everyone loves so much. I recently priced a similar plan last year for my 23 year-old daughter and it cost just $52/month. Imagine how cheap it would be in a shared risk pool?

9. Get the Costs of Illegal Aliens Out With a National Prop 187: In 1994, the people of California reacted to the growing sea of illegal aliens crossing the border by enacting Proposition 187. It was a huge victory for a state that was sick and tired of watching billions of tax dollars being thrown at illegal aliens year after year by spineless politicians.

Proposition 187 included the following key elements:i.

i. All law enforcement agents who suspect that a person who has been arrested is in violation of immigration laws must investigate the detainee’s immigration status, and if they find evidence of illegality they must report it to the attorney general of California, and to the federal Immigration and Naturalization Service (INS).

ii. Local governments are prohibited from doing anything to impair the fulfillment of this requirement.

iii. The attorney general must keep records on all such cases and make them available to any other government entity that wishes to inspect them.

iv. No one may receive public benefits until they have proven their legal right to reside in the country.

v. If government agents suspected anyone applying for benefits of being illegal immigrants, the agents must report their suspicions in writing to the appropriate enforcement authorities.

vi. Emergency medical care is exempted, as required by federal law, but all other medical benefits have the requirements stated above.

vii. Primary and secondary education is explicitly included.

Although the courts screwed things up in 1999 by ruling that Prop 187 was unconstitutional, this is probably the best solution to the number one cost driver, not only for the healthcare system, but schools as well. My 9th strategy would be to implement the “essence of Prop 187” on a national level as part of a “comprehensive immigration bill,” which also would include tightening our borders.

10. A National 2% Value Added Tax (VAT) Dedicated to Debt Reduction: What did you say; how can Dave advocate new taxes? Trust me; I’m not suggesting this casually. It’s just that we must get serious about deficit reduction and paying back the national debt. My 10th strategy would be to pass a Constitutional Amendment that created a 2% Value Added Tax that would only be used for deficit reduction and one that would end when the debt reached zero. By the way, I wouldn’t touch this one until we’d finished the other 9 strategies. You may not know it, but every major industrial nation on earth is toying with chronic deficit spending as a strategy for fighting this economic recession. In fact, that’s the only reason the dollar hasn’t completely collapsed. But if we could take the global lead on eliminating our national debt, our economy would take off and we would once again be the envy of the rest of the world.

I realized that some of you will have trouble with one or two of these strategies, but taken in total, I am convinced that they represent the best formula for ending chronic deficit spending and launching America into the greatest economic boom in history.

What do you think?

Dave

Clearly, the problem with the US education system is not lack of funding. I believe that the amount of money that flows through our education system is actually the cause of the problem.

Clearly, the problem with the US education system is not lack of funding. I believe that the amount of money that flows through our education system is actually the cause of the problem.

Further Reading: In 1979, Time Magazine published an article called Inflation: Who Is Hurt Worst? that looked back at last great inflation attack that followed the Jimmy Carter regime (click

Further Reading: In 1979, Time Magazine published an article called Inflation: Who Is Hurt Worst? that looked back at last great inflation attack that followed the Jimmy Carter regime (click