Coach K didn’t think much about President Obama taking time out from working on the economy to fill in his March Madness brackets, but I kind of liked it. With all this doom and gloom going on, it’s nice to see our president acting like things are normal. It reminded me of the way I felt at 7:07 AM on September 15, 2001 when the first TV commercial came on the air after 4 days of back to back 9/11 news.

Photo From http://www.rushlimbaugh.com

This time it wasn’t the footage of smoldering buildings that had me down, it was Barney Frank, doing his best imitation of Joe McCarthy as he presided over the AIG bonus inquest.

Specifically, as I’m watching Barney Frank and the gang beat up Ed Liddy, I hear a term that I haven’t heard in years, Retention Bonuses…

Retention Bonuses Aren’t Bonuses

I immediately flashed back to a dark day in Dave Horne bonus history. It was 2002 and I was an Executive Vice President at i2, the company was struggling big time and we were cutting staff throughout the company.

Trust me folks, making decisions about laying off people you’ve known for years is no fun, I hope you never have to do it. I was having a hard time sleeping through the night.

I’ll never forget the week I went ballistic.

I’ll spare you the details of why I went nuts – actually, I’m probably bound to secrecy by some legal agreement — but suffice it to say, in 5 short days, I became convinced that the company was unfairly cutting people on my staffing.

So like I said, I went crazy and on Saturday morning of that week — I just quit. I didn’t quit the smart way, you know the way I tell everybody else to quit, get another job first, don’t burn your bridges…

I was burning bridges like there was no tomorrow I said:

“I’m done, I’m never go back to the office, I don’t give a BLEEP what you tell the people who work for me or my customers, you’re all stupid, dishonest, or both, I don’t care, I’ve had it!”

Man did that feel good. So anyway, Sunday the CEO calls me back and makes me an offer.

He asks me to come back for two weeks

He asks me to announce my retirement

He asks me to be available to talk to customers for the next three months

And then I heard the word – “We’ll pay you a generous retention bonus”

Like I said, I’m legally prohibited from telling you how big that bonus was, but I will tell you that it translated into an pay rate that was an order of magnitude higher than I was getting paid just to do my job.

So why did they offer me a fat retention bonus?

Don’t get me wrong – they hated me, I personally insulted them, I put their company at risk, I probably scared off some customers — at a time when they really needed customers.

Of course they deserved it!

They offered me a juicy bonus for one reason and one reason only — It made business sense

They figured it would cost then a lot more to just let me walk out the door. So as you can imagine, the congressional inquest into AIG Bonuses really hit a nerve with me.

As Ed Liddy clearly stated, these bonuses were not for performance, they were simply to retain key people, who had been fired, and entice them into helping to clean up the mess that we, the American taxpayers had bought 80% of for $180 billion. These retention bonuses weren’t being paid out of greed, they were being paid for good business reasons.

Unintended Consequences in France

Within hours of doing this week’s Career Mechanic show, a story breaks in The Wall Street Journal, that completely proves my point.

THE WALL STREET JOURNAL

AIG Fights a Fire at Its Paris Unit

Executives’ Resignations Put Billions in Contracts at Risk of Default

Yep, it’s true. All the heat over Bonus Madness has led to two key AIG executives deciding to give back their retention bonuses and leave the company. Their departure now puts our $180 billion investment in AIG in deeper jeopardy. Nice work Barney!

CEO’s Good – Congressional Grandstanding Bad

By now you’re probably saying “interesting angle Dave, but what does this have to do with my career?”

Good question and here’s the answer. These clowns in Washington are not going to save your career. They’re playing fast and loose with our money. They’re simply dragging villains into hearings and beating them up to show you how much they care. If you ask them, they’ll probably say that they care about your career, but if you look at their actions, they’re not doing squat.

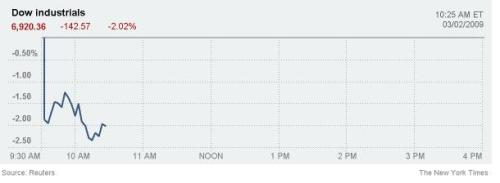

But yet we continue to see the economy coming back to life. Last week we saw better housing numbers and durable goods orders. How can this be happening if it’s not due to the efforts of Barney Frank and the gang in Washington DC? The fact is, the so-called Stimulus Package hasn’t even kicked in yet and things are getting better – how come?

It’s because “the fundamentals of the US economy are strong” (to quote John McCain). American CEO’s have suffered threw at one and as many as three recessions in the last 18 years and they have a pretty good game plan for hunkering down and weathering the storm.

Want to know more? Listen to this week’s Career Mechanic (www.thecareermechanic.com) and hear from it first hand from Steve King, a very successful CEO.

You can also do your career a favor by listening to Robin Kessler – The Interview Coach discuss the latest technique for resumes and job interviews. It called Competency Focus and Robin has written several great books on the subject.

The Career Mechanic This Week – Digging Out Of The 2009 Economy

www.thecareermechanic.com

Signs that we’ve reached the bottom continue to pile up. Amazing, considering that the Government’s $800 billion stimulus package has yet to “leave the launch pad?” Meanwhile, Washington continues to amuse themselves with “Bonus Mania.” If (and I know it’s a big if), the economy is coming back, it’s likely due to the ingenuity of the CEO’s of America. You think I’m kidding? Join us this week with our guest Steve King and hear how he turned around a very troubled company in the last recession and created hundreds of good jobs. We’ll also be joined by Robin Kessler – AKA The Interview Coach, who will talk about the latest technique for resumes writing, job interviews and performance reviews.